Becoming invest savvy without a financial advisor has been this wild ride for me, seriously. Like, here I am in my messy living room in the Midwest – it’s January, snow piling up outside my window, the heater humming like it’s judging me, and I’m sipping lukewarm coffee while staring at my portfolio app. I never thought I’d get here without handing over cash to some suit, but yeah, I did it mostly solo, with a ton of screw-ups along the way.

My Rocky Start to Becoming Invest Savvy

Okay, confession time – I was clueless. Back in my late 20s, living in a tiny apartment in Chicago, I dumped a chunk of my bonus into some meme stock because everyone on Reddit was hyped. Lost like 40% in a month. Felt sick, literally – stomach in knots, avoiding my phone notifications. That embarrassment? It lit a fire under me to actually learn how to become invest savvy without relying on anyone else.

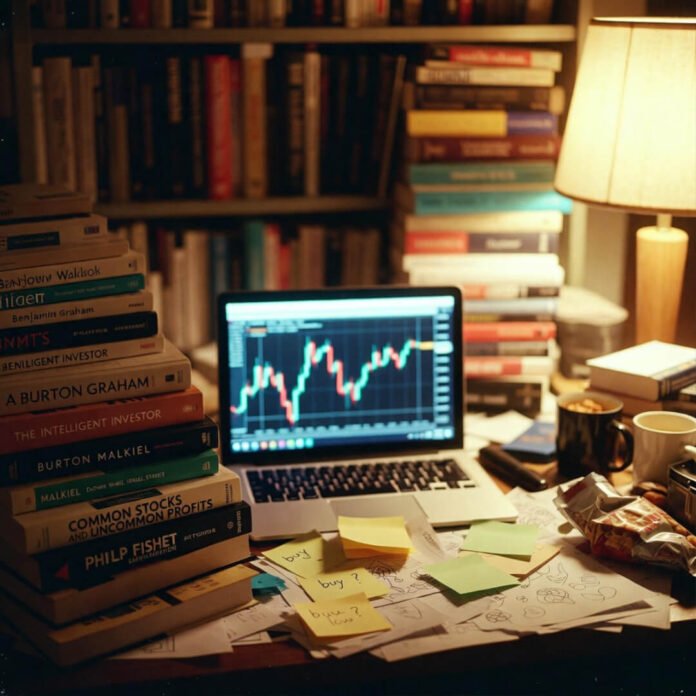

I started simple: grabbed free resources online. Investopedia became my late-night rabbit hole, and I binged Morningstar’s investing classroom stuff. No advisor fees, just me, my laptop, and a growing pile of tabs.

Key Steps I Took to Become Invest Savvy on My Own

Anyway, fast forward – here’s what actually worked for me to become invest savvy without an advisor. No BS, just what clicked after trial and error.

Picking the Right Books to Build My Invest Savvy Foundation

Books were huge. I snagged used copies because, duh, saving money. “The Little Book of Common Sense Investing” by John Bogle totally shifted my mindset to low-cost index funds. Then “The Intelligent Investor” by Benjamin Graham – dense, but eye-opening on value stuff. And “The Psychology of Money” by Morgan Housel? Hit me hard on the behavioral side, like why I chase hot tips sometimes.

- Pro tip: Start with Bogle’s stuff if you’re overwhelmed. It’s straightforward.

- I read them on my balcony last summer, dodging mosquitoes – sensory overload, but worth it.

Linked some faves: The Little Book of Common Sense Investing, The Psychology of Money.

Free Tools That Helped Me Become Invest Savvy Fast

Didn’t pay for courses. Yale’s free financial markets class on Coursera? Gold. Vanguard and Fidelity’s investor education sections – super practical. And simulators to practice without losing real money.

I paper-traded for months, pretending with virtual cash. Avoided more dumb moves that way.

Common Pitfalls on the Path to Invest Savvy (That I Totally Fell Into)

Look, becoming invest savvy means eating dirt sometimes. I panicked sold during a dip – classic emotional crap. Didn’t diversify early, too concentrated in tech. Ignored fees eating my returns slowly.

Now? I preach diversification like a broken record. Index funds forever, baby. Spread it out: S&P 500 ETF, some bonds, international.

Wrapping Up My Journey to Become Invest Savvy

These days, sitting here in 2026 with a decent nest egg building, I feel… cautiously proud? Still flawed – I check my app too much, get FOMO spikes. But becoming invest savvy without a financial advisor proved I could handle my own money. Contradictory as it sounds, the mistakes made me better.