Pay off debt faster – man, that’s something I never thought I’d be saying from experience, but here I am, sitting in my messy apartment in suburban Chicago on this chilly January morning, coffee going cold beside me, finally breathing easier because some smart financial tools actually pulled me out of the hole.

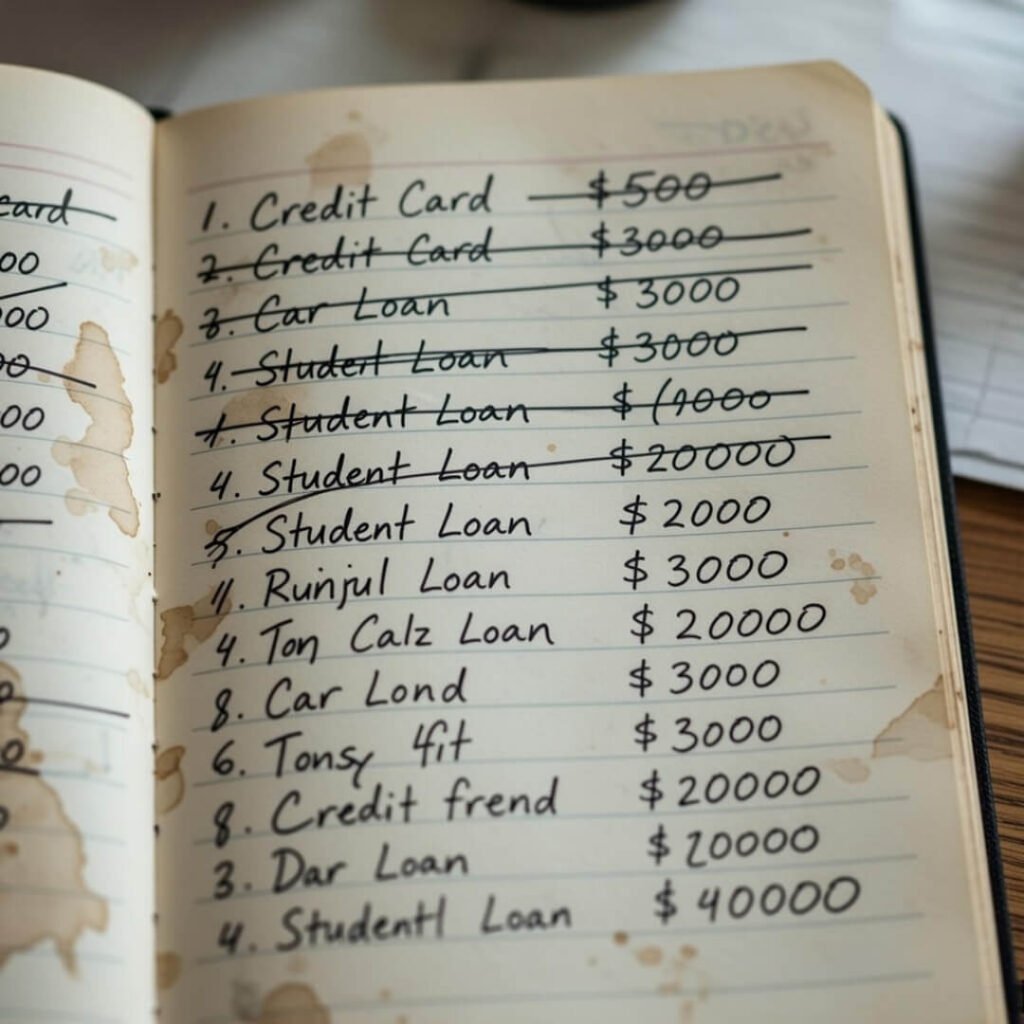

Seriously, like, a couple years back I was buried under about $28,000 in credit card debt and a car loan that felt endless. It started innocently enough – you know, that “treat yourself” vibe after a rough breakup, swiping for takeout, vacations I couldn’t afford, and yeah, some dumb impulse buys during late-night Amazon scrolls. I remember this one time, I maxed out a card on a designer bag because “I deserved it” after a promotion… only to panic when the bill hit and I was eating ramen for weeks. Embarrassing? Totally. But raw honesty here: I was avoiding my statements like they were bad ex texts. Anyway, fast forward to hitting rock bottom when I couldn’t even cover minimums without juggling, and I knew I had to find ways to pay off debt faster or I’d be stuck forever.

Why Smart Financial Tools Were a Game-Changer for Paying Off Debt Faster

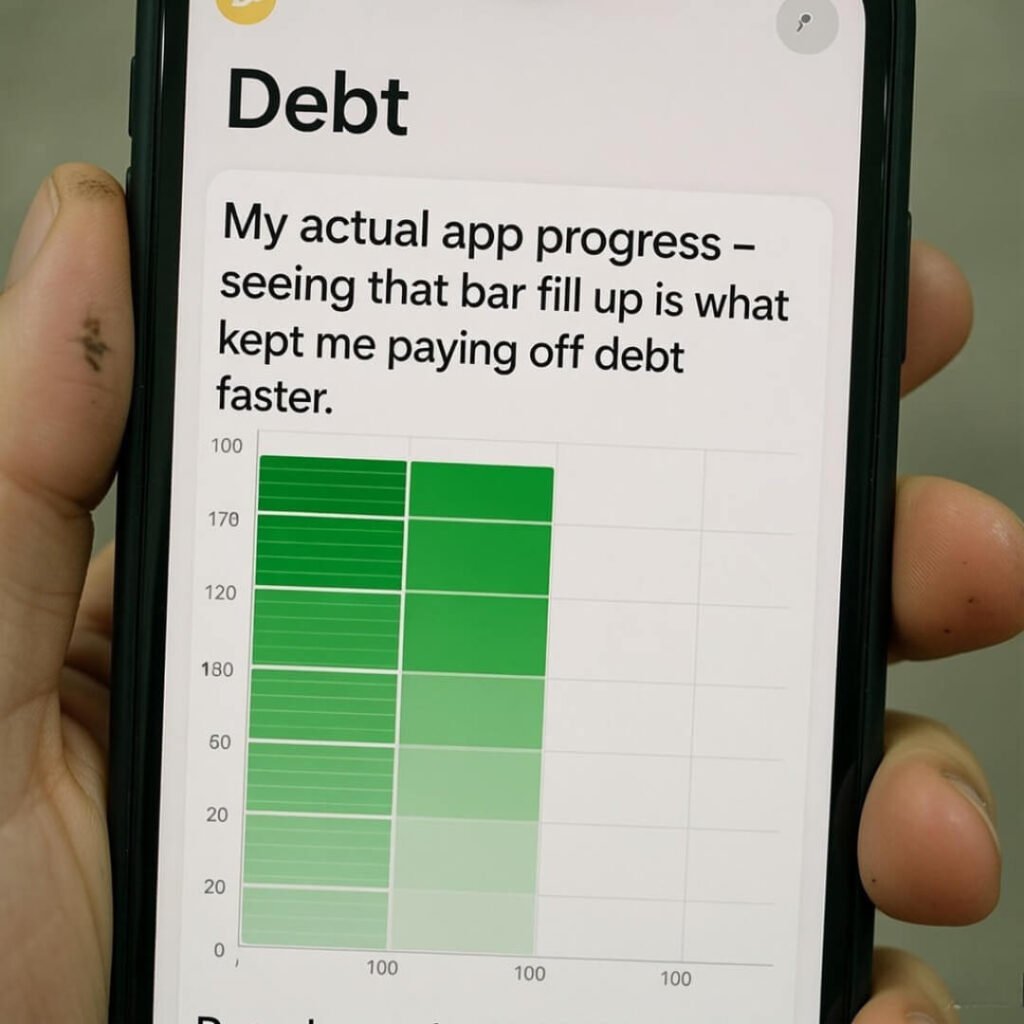

Look, I tried the whole “just pay more” thing at first, but without structure, it was chaos. I’d throw random extra cash at bills, feel good for a day, then splurge again. Contradictory, right? That’s me – flawed American dreaming big but messing up the details. But then I stumbled on these smart financial tools, and they gave me visuals, plans, motivation… stuff that made paying off debt faster feel doable, not impossible.

I started with free online calculators to compare methods. Turns out, there’s the debt snowball (pay smallest debts first for quick wins) versus avalanche (hit high-interest first to save money long-term). I went hybrid because math said avalanche, but my brain needed snowball wins to not quit.

The Debt Snowball vs Avalanche Debate: What Worked for Me to Pay Off Debt Faster

Okay, confession: I started with snowball because seeing a zero balance on that $500 store card felt like winning the lottery. Seriously, I celebrated with cheap pizza – ironic, huh? But then I switched to avalanche for the bigger cards sucking me dry with 24% interest. Tools like Undebt.it (free web-based, super customizable) let me plug in numbers and see timelines. It showed me paying off debt faster by focusing on interest, saving me probably $2,000 overall.

According to Ramsey Solutions, snowball builds behavior momentum, while avalanche is mathematically better. I get both – snowball kept me going when I was doubting everything.

Here’s what I loved about some top tools:

- Undebt.it: Free, supports both methods, charts your progress. I checked it obsessively, like doom-scrolling but productive.

- Debt Payoff Planner app: Mobile, easy to track on the go. Pro version has reminders – worth it for forgetful me.

- YNAB (You Need a Budget): Not just debt, but budgeting that freed up cash to pay off debt faster. Changed how I saw every dollar.

I linked to these because they worked for me – check out Undebt.it or Debt Payoff Planner if you’re starting.

My Favorite Smart Financial Tools That Helped Pay Off Debt Faster

These aren’t sponsored or whatever – just what got me through.

- Free calculators like Unbury.me: Quick “what if” scenarios. Showed me extra $200/month could shave years off.

- PocketGuard or similar for tracking: Caught sneaky subscriptions draining my “extra” money.

- Spreadsheets – yeah, old school: I made my own in Google Sheets, tracking every payment. Felt personal, like owning the mess.

One embarrassing story: I once “snowflaked” – threw a $50 birthday gift straight at debt instead of blowing it. Small, but added up. Now I’m all about those windfalls going to payoff.

Real Talk: The Mistakes and Wins in My Journey to Pay Off Debt Faster

I screwed up plenty – refinanced wrong once, paid fees for nothing. And yeah, side hustled driving Uber on weekends, smelling like fast food, questioning life. But paying off that last card? Tears, legit. Sitting here now, window foggy from the heater, no more dread opening mail.

These smart financial tools didn’t magic it away, but they made paying off debt faster realistic. I learned I’m capable, even with my contradictions – love nice things but hate stress more.

Wrapping This Up – Your Turn to Pay Off Debt Faster

Anyway, if you’re in the trenches like I was, pick one tool today. Start small, forgive the past mess-ups (I still cringe at that bag), and go. You’ve got this – hit me in comments if you try these, or share your chaos. Let’s chat, seriously.